Description

Chapter 1: The Individual Income Tax Return

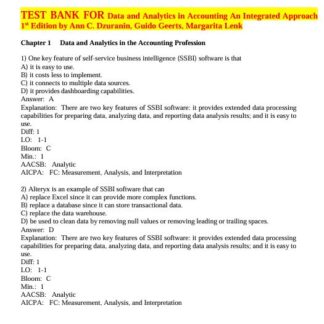

1. A corporation is a reporting entity but not a tax-paying entity.

True False

2. Partnership capital gains and losses are allocated separately to each of the partners.

True False

3. Married taxpayers may double their standard deduction amount by filing separate

returns.

True False

4. An item is not included in gross income unless the tax law specifies that the item is

subject to taxation.

True False

5. For taxpayers who do not itemize deductions, the standard deduction amount is

subtracted from the taxpayer’s adjusted gross income.

True False

6. A taxpayer with self-employment income of $600 must file a tax return.

True False

7. A dependent child with earned income in excess of the available standard deduction

amount must file a tax return.

True False

8. A single taxpayer, who is not blind and who is under age 65, with income of $8,750

must file a tax return.

True False

Reviews

There are no reviews yet.